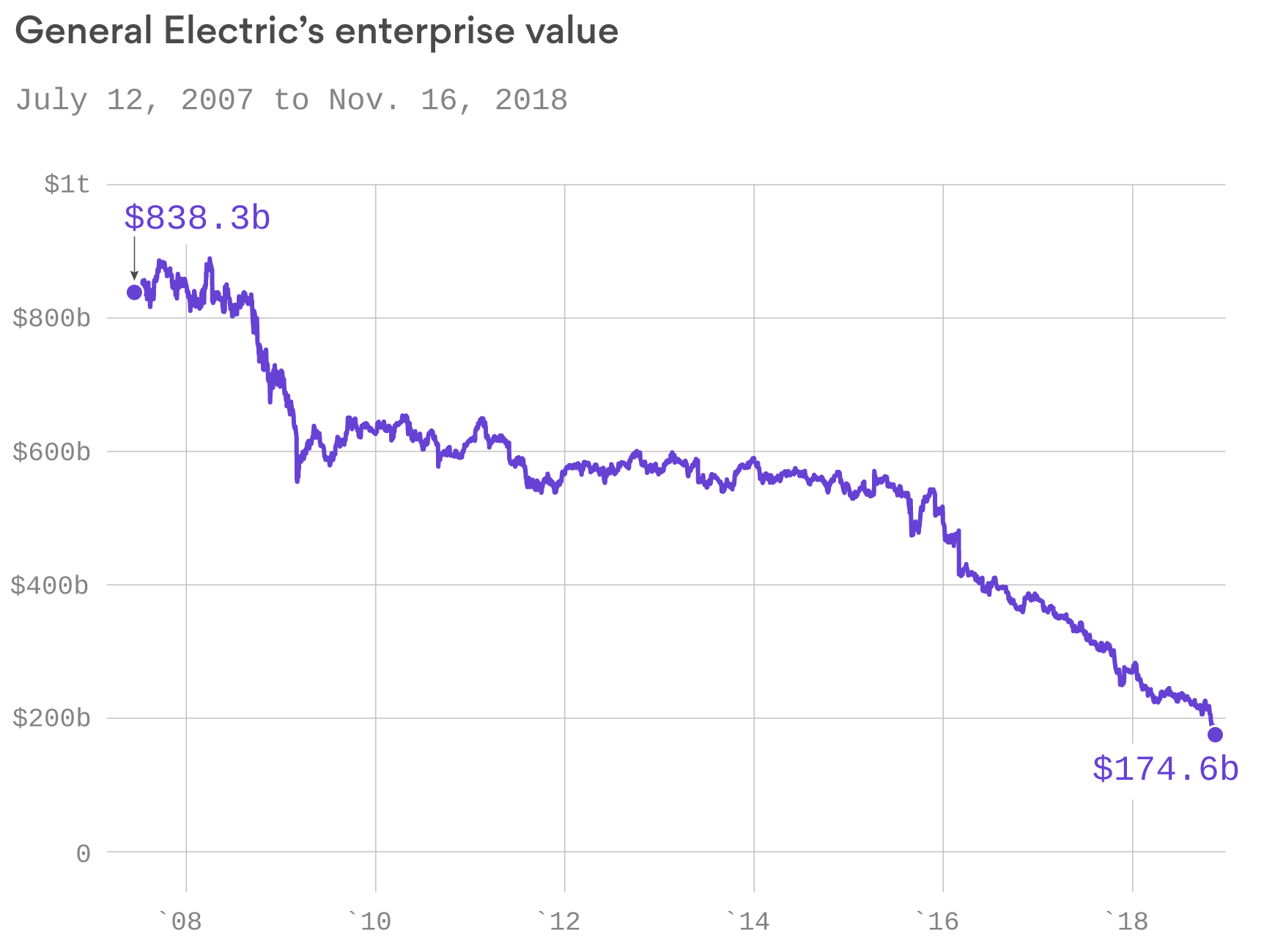

| 4. General Electric deflates |

Data:FactSet; Chart: Lazaro Gamio/Axios

General Electric would love to have a share price down 35% from its highs. The stock closed Friday at just $8.02 per share, which is down 75% from the July high of $33, down 80% from the pre-crisis high of $42, and down 85% from the all-time high of $60, set in August 2000. And those numbers if anything understate the degree to which GE has been diminished since its heyday.

No one's shedding any tears for speculators like Nelson Peltz, who has lost some $700 million on his GE bet. But GE bondholders are a different matter. GE has a total debt of $115 billion, including $100 billion of long-term bonds. That's more than its market capitalization.

To see just how bad things are looking for GE, consider its perpetual preferred securities. If GE doesn't buy back that paper at par in January 2021, it's going to have to pay a punitive 333 basis points over Libor in interest. And it's looking very much as though GE won't have the wherewithal to buy back the stock.

The bottom line: GE Capital needs at least $20 billion in new funds, and perhaps significantly more, according to a research note put out by Goldman Sachs this week. Goldman also raised questions about GE's insurance and power operations.

Why it matters: GE is far from insolvent, but it's definitely in trouble. If its $100 billion of debt got downgraded to junk status, the effect on the credit markets could be seismic.

|

LAST SUMMIT FUTURE- we come to bury science fiction only natural science ai matters to those who love millennials

AdamSmith.app notes it took 10 quarters of a century for USA to listen to intel of1 billiongirls; fortunately this happened in Clara's town the patron saint of health for mothers & infants also the Pacific Coast East birthplace of 1965 Moore's chips, and 2016 Hoppers 80 billion chip Gpu. In the most exciting AI20s.com, at EconomistWomen.com invite you to Gamify worldclassllm by celebrating greatest herstories through every community on earth's new & old worlds

2025report (est 1983 Economist) final ed invites EconomistAmerica.com: update ED's 1982 Economist Survey with Doerrs & others )Why Not Silicon Valley Everywhere/

Can Economists map 8 billion human relationships to be joyful and sustainable. This centuruy old question begun by Maths Goats Neumann Eintstein et al is coming down to the wire: extinction or sustainability of speies -2030reports.com . 2 main protagonits since 1970a billion poorest asian women have mapped quarer of the world's population's development with deeer joy and sustainability than all the wealth of American-English mindsets. Somwehere in netween the majority of human intels and almost infinet ART Intels wonder what UN2 countdown to 2030 can do next...LET's start with mapping SHELFF economies : S5 She-too womens intel built communities S3 Health: S4 Ed3 S0 LandLeaders s2 Food S1*17 Financial platforms (the 100 grey=blocks of intel between Unations & WallStreets

Can Economists map 8 billion human relationships to be joyful and sustainable. This centuruy old question begun by Maths Goats Neumann Eintstein et al is coming down to the wire: extinction or sustainability of speies -2030reports.com . 2 main protagonits since 1970a billion poorest asian women have mapped quarer of the world's population's development with deeer joy and sustainability than all the wealth of American-English mindsets. Somwehere in netween the majority of human intels and almost infinet ART Intels wonder what UN2 countdown to 2030 can do next...LET's start with mapping SHELFF economies : S5 She-too womens intel built communities S3 Health: S4 Ed3 S0 LandLeaders s2 Food S1*17 Financial platforms (the 100 grey=blocks of intel between Unations & WallStreets

AdamSmith.app notes it took 10 quarters of a century for USA to listen to intel of

2025report (est 1983 Economist) final ed invites EconomistAmerica.com: update ED's 1982 Economist Survey with Doerrs & others )Why Not Silicon Valley Everywhere/

| See the world of Jensen, Li , Hassabis &&& Neumann survey What good will humans unite wherever get first access to 100+ times more tech every decade: Jensen liftoff 1996 Li & Hassabis (DeepTrain Computers) first seen in valley 2009; moment1 2012 Global Games Imagenet, moment 2a alphafold go world champon & Google Transformer Attention Before we our 1982 intervuewDoeers in 1965 the twin Clara-Tokyo .Exps appeared: Intel's 100 times moore tech per decade Tokyo olympics sighting of Satellite telecoms (EJ:see 3 leaders vision connections JFK , Prince Charles, Emperor Hiorhito) - | Why not co=pilot JLHABITAT MAGIC everywhere- ie celebrate brainpower innovation maps : Jensen*Li*Hopper*Alphafold2*Blackwell*Intel*Transformer*Attention*Twins - MediateAGIChaos started up around Einsten and his revolution in margs of nature teamed up as NET: Neumann-Einstein-Turing. Sadly for 30 years the 20th C asked its 3 greatest maths brains to win atomic bomb race for allies -this left them 1951-6 to train Econonist Journalosts and others round last notes computer & brain on 2 new engines type 6 brainworking. type 7 Autonomous Intelligence Mapping |

Can Economists map 8 billion human relationships to be joyful and sustainable. This centuruy old question begun by Maths Goats Neumann Eintstein et al is coming down to the wire: extinction or sustainability of speies -2030reports.com . 2 main protagonits since 1970a billion poorest asian women have mapped quarer of the world's population's development with deeer joy and sustainability than all the wealth of American-English mindsets. Somwehere in netween the majority of human intels and almost infinet ART Intels wonder what UN2 countdown to 2030 can do next...LET's start with mapping SHELFF economies : S5 She-too womens intel built communities S3 Health: S4 Ed3 S0 LandLeaders s2 Food S1*17 Financial platforms (the 100 grey=blocks of intel between Unations & WallStreets

Can Economists map 8 billion human relationships to be joyful and sustainable. This centuruy old question begun by Maths Goats Neumann Eintstein et al is coming down to the wire: extinction or sustainability of speies -2030reports.com . 2 main protagonits since 1970a billion poorest asian women have mapped quarer of the world's population's development with deeer joy and sustainability than all the wealth of American-English mindsets. Somwehere in netween the majority of human intels and almost infinet ART Intels wonder what UN2 countdown to 2030 can do next...LET's start with mapping SHELFF economies : S5 She-too womens intel built communities S3 Health: S4 Ed3 S0 LandLeaders s2 Food S1*17 Financial platforms (the 100 grey=blocks of intel between Unations & WallStreets

Monday, November 12, 2018

is the failure to apply common sense media to the way facebook and amazon have destroyed us communities related to how ge's old fashioned bigness has been penalised- warren buffett beware?

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment